Renters Insurance in and around Mount Laurel

Welcome, home & apartment renters of Mount Laurel!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Home is home even if you are leasing it. And whether it's an apartment or a townhome, protection for your personal belongings is a good precaution, especially if you could not afford to replace lost or damaged possessions.

Welcome, home & apartment renters of Mount Laurel!

Your belongings say p-lease and thank you to renters insurance

Why Renters In Mount Laurel Choose State Farm

Renters often underestimate the cost of refurnishing a damaged property. Just because you are renting a property or space, you still own plenty of property and personal items—such as a bed, laptop, microwave, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why get renters insurance from Dane Cox? You need an agent with the knowledge needed to help you evaluate your risks and understand your coverage options. With wisdom and competence, Dane Cox is here to help you insure your precious valuables.

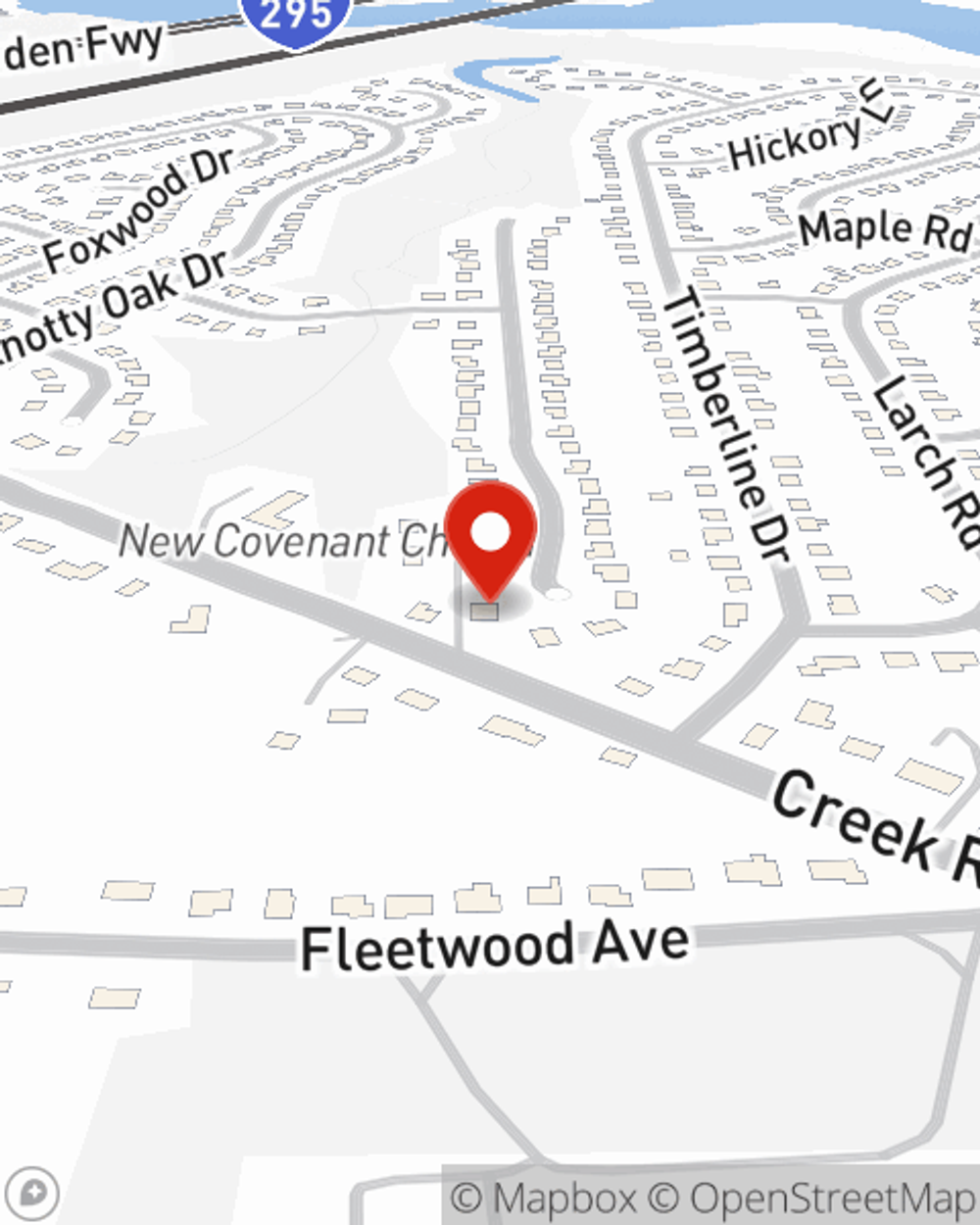

A good next step when renting a apartment in Mount Laurel, NJ is to make sure that you're properly protected. That's why you should consider renters coverage options from State Farm! Call or go online today and find out how State Farm agent Dane Cox can help you.

Have More Questions About Renters Insurance?

Call Dane at (856) 242-2014 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.